In jioRead time: Under 4 minutes

Welcome Back Investor!

The Fed may have held rates steady, but Jerome Powell’s message came with a sharp edge. In his latest remarks, he flagged five major risks that could shape the market’s next move, starting with sticky inflation and signs of slowing growth. Add in rising fears of stagflation, fresh global trade tensions, and delayed rate cuts, and the calm on the surface starts to look shaky underneath..

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Focal Point: FIIs make a strong comeback, bet big on Indian Financials

▪️ Markets

▪️ Everything else you need to know today

▪️ Strategy: Break free from the 10 habits that could be keeping you financially stuck.

▪️ Stock Screener to up your game

FOCAL POINT

No Rate Cut Yet: Powell's 5 Warnings Every Investor Must Hear

On May 7, 2025, the U.S. Federal Reserve chose to hold its benchmark interest rate steady at 4.25% - 4.50%, marking the fourth consecutive policy meeting without a change.

1. Economic Uncertainty: The U.S. economy shrank by 0.3% in Q1 2025 on an annualized basis, with manufacturing output declining for the second month in a row. These signs of a slowdown raise red flags about potential broader economic weakness.

2. Persistent Inflation: While inflation has eased from its 2022 highs, it remains above the Fed’s 2% target. This stickiness suggests that aggressive rate cuts remain off the table for now.

3. Tariff Pressures: Former President Donald Trump’s renewed tariff policies have reintroduced trade-related uncertainty.

4. Stagflation Concerns: The simultaneous rise in inflation and unemployment is reviving fears of stagflation, a difficult economic condition the Fed is keen to avoid.

5. Delayed Rate Cuts: Given the current data, the Fed signaled that rate reductions are unlikely before September 2025, reinforcing a cautious, data-dependent policy stance.

MARKETS

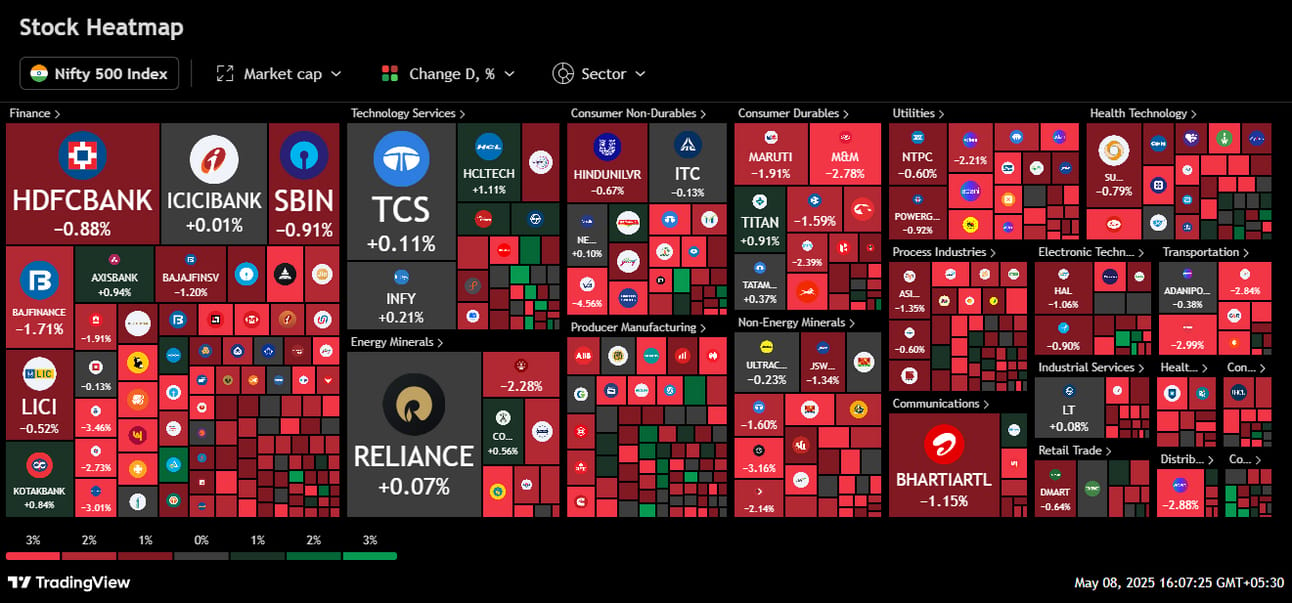

On May 8, the Indian market slipped into the red as major indices posted sharp losses. Sensex dropped 412 pts (-0.51%), Nifty 50 fell 140 pts (-0.58%), and Bank Nifty slid 245 pts (-0.45%), but the real blow came from the Midcap 100, which tanked 1,058 pts (-1.95%), showing deep cracks in broader market sentiment. Caution is creeping in, Investors are clearly risk-off as volatility brews beneath the surface.

Closing figures as on 08.05.25 (3.30pm IST)

🔻 SENSEX | 80,334.81 | -0.51% |

🔻 NIFTY 50 | 24,273.80 | -0.58% |

🔻 NIFTY BANK | 54,365.65 | -0.45% |

🔻 NIFTY Midcap 100 | 53,229.30 | -1.95% |

🔻 NIFTY Smallcap 100 | 16,183.75 | -1.43% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ HCL Tech - ₹1,580.70 +1.11% Tech got a boost as HCL saw fresh buying on stable earnings optimism.

✅ Axis Bank - ₹1,172.20 +0.94% Banking stock remained resilient despite sector pressure, solid volumes showed buyer interest.

✅ Titan Company - ₹3,369.30 +0.91% Festive demand and premium positioning kept Titan shining in an otherwise dull session.

✅ Kotak Mahindra - ₹2,112.60 +0.84% Defensive buying helped Kotak stay green as investors sought safety.

Top Losers

🔻 Shriram Finance – ₹615.80 -3.27% Heavy selling dragged the NBFC stock, possibly on valuation concerns or sector rotation.

🔻 Eternal – ₹229.81 -2.99% High volume, sharp drop, suggests aggressive profit booking or weak sentiment.

🔻 Adani Enterprises – ₹2,285.30 -2.88% Selling pressure hit the Adani flagship, weighing down the broader market too.

🔻 M&M (Mahindra & Mahindra) - ₹3,033.10 -2.78% Auto sector correction in play; M&M faced heat despite recent strong momentum.

NIFTY 500: Blood Bath 💣

Q4 RESULTS

Company | YoY | QoQ |

|---|---|---|

👍🏻 | 👍🏻 | |

👍🏻 | 👍🏻 | |

👍🏻 | 👍🏻 | |

👎🏻 | 👎🏻 |

Click on company name for result pdf

FROM THE FRONTIER

Everything else you need to know today

🌎 Geo-Jitters: Markets wobbled as geopolitical tension spiked, India’s announcement of neutralizing a cross-border threat, the rupee weakened, bond yields rose, and equities turned red.

📊 IPO Showdown: NSE wants the government to step in, India’s largest stock exchange is locked in a regulatory tussle with SEBI that could delay upcoming IPOs.

🚗 Tesla Speed Bump: Tesla’s India head has resigned, at the worst possible time, Just as the EV giant planned its launch in Delhi and Mumbai, leadership vacuum threatens progress.

⚡ EV Lifeline: BluSmart is pushing for a $30M revival package, Backed by investors, the EV ride-hailing startup is trying to stay alive after heavy losses. With this funding, BluSmart hopes to reset operations and reclaim its position as India’s clean-mobility disruptor.

4 Reasons The Dollar Could Collapse

If you’ve noticed that your dollars don’t seem to go as far as they used to, you’re not alone. Millions of Americans are in the same boat.

The recent inflation rate, the highest in over 40 years, was a wake up call that made many people realize that the financial stability they had taken for granted for decades no longer exists.

The US government has been tempted to use its reserve currency status to its financial advantage. This has resulted in massive devaluation of the dollar.

A way to help protect your dollars is to diversify your money with assets that don’t depend upon the strength and health of the dollar for their value. Precious metals like gold and silver, for instance, are in demand around the world 24/7 and aren’t dependent upon the value of the dollar.

To find out reasons why experts are predicting the collapse of the dollar, request your free digital copy of the 4 Reasons the Dollar Could Crash eBook.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

ONEZERO-F ACADEMY

Break free from the 10 habits that could be keeping you financially stuck.

Living paycheck to paycheck isn’t just about low income, it’s often the result of quiet financial killers disguised as “normal” habits.

No Budget = No Control: Your money's running the show, not you.

Impulse Spending: Small splurges = big leaks.

Minimum Credit Payments: Interest snowballs. Debt grows silently.

No Emergency Fund: One shock = financial chaos.

Lifestyle Inflation: More money, more spending = no progress.

Skipping Financial Education: What you don’t know costs you more.

Delaying Investing: Time lost = returns lost.

Living on Debt: Credit cards aren’t backup plans.

No Financial Goals: No direction, no destination.

Emotional Money Moves Feelings don’t build fortune, discipline does.

SUPERCHARGE YOUR INVESTING SKILLS

Why I Never Chased Quick Money | Warren Buffett

STOCK SCREENER TO UP YOUR GAME

Fundamentally good Penny stock

by Sumit

Current price > 10 AND

Current price < 100 AND

Price to book value < 1 AND

Debt to equity < 0.5 AND

Promoter holding > 50 AND

YOY Quarterly sales growth > 1 AND

Pledged percentage =0 AND

OPM > 50

Thanks for reading.

Until tomorrow!

Mohit & the OneZero-F team

OneZero-F Analytics is SEBI registered Research Entity in terms of SEBI (Research Analyst) Regulations, 2014 with SEBI Research Analyst No: INH000013837. For more details, Click Here.

Click Here for Other DISCLAIMERS & DISCLOSURES