Read time: Under 4 minutes

Welcome Back Investor!

Indian stock markets started Tuesday on a muted note, with the Nifty 50 dipping 0.1% and the Sensex barely moving. The cautious tone comes after Donald Trump warned Tehran of “severe consequences” over reported threats to U.S. interests raising geopolitical stakes in an already fragile global environment. Add to that subdued global cues and mixed signals from Asian peers, and traders are opting for wait-and-watch mode.

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Impact News

▪️ Markets

▪️ Everything else you need to know today

▪️ Special

▪️ Mindset

▪️ Stock Screener to up your game

IMPACT NEWS

Can India Withstand Soaring Crude Amid Geopolitical Heat?

As the Iran–Israel conflict enters Day 6, crude oil has surged over 7%, shaking global markets. But what about India?

A new report by Kotak Institutional Equities titled “Just What India Didn’t Need” says India’s $3.7 trillion economy can absorb a $10–$20/bbl spike in oil prices for now. However, the comfort has caveats.

🔻 Corporate Earnings may take a hit. Gains for upstream producers like ONGC could be offset by downstream pain think refiners and oil-dependent sectors.

💸 Fiscal Space is tight. With little room left for stimulus, the government may struggle to cushion shocks.

🏦 Monetary Policy is already stretched. The RBI’s rate cuts and liquidity moves leave limited options ahead.

Beyond numbers, there’s the strategic risk: if tensions flare into a proxy war or disrupt the Strait of Hormuz (which channels 20% of global oil), this could go beyond inflation threatening India’s valuation narrative.

Low oil has long been India’s macro tailwind. But in a world where diplomacy now bows to military might, can India stay shielded?

This may not be just a test of our economy but of our resilience in a shifting global order.

MARKETS

Indian markets closed slightly in the red today, with both the Sensex and Nifty 50 slipping 0.17%, signaling mild profit booking. The Nifty Midcap 100 took a sharper hit, down 0.46%, while Nifty Bank stood out with a +0.21% gain, driven by buying interest in financials. Overall, a mixed day as investors tread cautiously amid global uncertainty and upcoming Fed signals.

Closing figures as on 18.06.25 (3.30pm IST)

🔻 SENSEX | 81,444.66 | -0.17% |

🔻 NIFTY 50 | 24,812.05 | -0.17% |

✅ NIFTY BANK | 55,828.75 | +0.21% |

🔻 NIFTY Midcap 100 | 58,109.20 | -0.46% |

🔻 NIFTY Smallcap 100 | 18,378.45 | -0.23% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ IndusInd Bank (+5.11%) Despite recent accounting issues, Nomura expects a turnaround with improved governance, a clean-slate FY26 plan, and RoA forecast to rise to 1% by FY27.

✅ Trent (+1.93%) Momentum from strong Q4 earnings and retail expansion. Investors remain bullish on its fashion & retail strategy and digital integration, driving volume-based gains.

✅ Titan Company (+1.82%) Benefiting from safe-haven sentiment and luxury demand. Amid global uncertainty, Titan’s gold and jewellery segment is seen as resilient, attracting defensive buying.

✅ Maruti Suzuki (+1.21%) Riding on strong sales outlook and EV developments. Market sentiment lifted by expectations of robust rural demand and early signs of a successful EV push.

Top Losers

🔻 TCS (−1.82%) Dragged by global tech weakness and profit-taking. Investors booked gains after a steady run-up; caution also builds ahead of U.S. Fed comments and IT budget concerns globally.

🔻 Adani Ports (−1.41%) Weakness linked to geopolitical tension. Israel-Iran conflict raises risk premium on global shipping and port operations, hurting sentiment around logistics players.

🔻 Hindustan Unilever (HUL) (−1.34%) Selling pressure on valuation fears. With high P/E multiples, FMCG stocks like HUL often face pullbacks during rate-sensitive or uncertain market cycles.

🔻 JSW Steel (−1.33%) Impacted by weak global demand and export headwinds. Steel sector outlook faces pressure due to slowing infrastructure investments and softening global metal prices.

INDIA FRONTIER

Everything else you need to know today

💊 Expansion: India’s top pharma firms like Sun Pharma, Cipla, and Dr. Reddy’s now hold a record ₹80,000 crore cash pile and are targeting global acquisitions from U.S./EU generics to tech-driven healthcare startups.

⚖️ Tension: Gold prices remain flat as investors await the Fed’s rate decision. Middle East tensions offer support, but profit booking and lower rate cut expectations keep demand subdued.

🏦 Oversight: RBI is probing Standard Chartered for selling complex derivatives (target redemption forwards) to SMEs without proper disclosures. Also flagged: reserve maintenance and accounting lapses.

💡 Empowerment: Jio BlackRock Mutual Fund launches Aladdin, a powerful investment analytics platform by BlackRock, offering risk management tools and AI-driven insights to Indian retail and institutional investors.

SPECIAL

🌍 Amid Global Uncertainty, India Emerges as a Rare Bright Spot

In a world reeling from geopolitical shocks Israel-Iran tensions, the Russia-Ukraine war, and economic slowdowns India is defying the odds.

Chief Economic Advisor V. Anantha Nageswaran calls India a “bright spot” in the global economy. With a resilient 6.5% GDP growth rate, improved fiscal strength, and a narrowing bond yield gap with the U.S., India is proving its macroeconomic mettle.

What sets India apart?

✅ A robust post-COVID recovery faster than many major economies

✅ Continued reduction in government debt without derailing growth

✅ Sustained investor confidence and stable monetary policy

✅ Strong defence exports and successful indigenization, reinforcing self-reliance

✅ Rising geopolitical influence, particularly in regional standoffs

The CEA also emphasized India's strategic maturity, highlighting how its calm, calculated response to global instability combined with reform-driven momentum positions the country as a stable, high-potential investment destination.

In a global landscape where downside risks outnumber upside surprises, India’s economic and strategic balance might be its strongest asset.

THE HANOOMAAN INSTITUTE

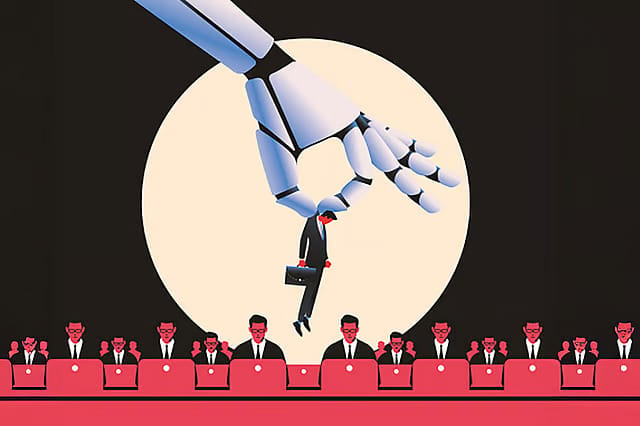

💼 AI and the Middle-Class Job Crisis – 2025 Breakdown

AI isn’t just changing the workplace it’s replacing core middle-class roles at record speed. From entry-level analysts to seasoned professionals, no desk job is off-limits.

Here's what you need to know about the white-collar job shakeup of 2025.

1. The Shift Is Real: AI has moved from helper to replacer, quietly taking over white-collar tasks once thought safe.

2. First to Go: Customer service, junior legal, admin, and entry-level tech roles are being automated at scale.

3. Why It Hurts More: These were “safe” jobs built on degrees now they’re vanishing, shaking career identity and stability.

4. Skills Gap Grows AI evolves in weeks; humans need years leaving workers behind in a race they didn’t start.

5. Profit Over People: Companies are cutting costs with AI, but the social cost is hitting workers and communities hard.

6. History Repeats: Like Wall Street before, industries are automating fast this time across every sector.

7. Emotional Fallout: It’s not just jobs people are losing purpose, facing identity crises in mid-career.

8. Data ≠ Comfort: AI creates jobs too, but not for those being displaced retraining is the new bottleneck.

9. Future’s in Our Hands: With bold leadership and re-skilling, AI can empower not erase our workforce.

SUPERCHARGE YOUR INVESTING SKILLS

STOCK SCREENER TO UP YOUR GAME

Companies with less than 10% dilution over 10 years.

by Pratyush

Number of equity shares <= Number of equity shares 10years back * 1.1 AND

Sales growth 10Years > 10% AND

Average return on capital employed 10Years > 10% AND

Market Capitalization > 100

Thanks for reading.

Until tomorrow!

Hanoomaan India Business team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. More details click here