Read time: Under 4 minutes

Welcome Back Investor!

In a bold projection, Morgan Stanley has set a potential 12-month target of 100,000 for the Sensex, signaling unprecedented optimism in India’s economic trajectory. Backed by robust earnings, deepening domestic participation, and structural policy reforms, India’s market is being re-rated on the global stage. This isn’t just a bullish bet, it’s a signal that India is stepping into the economic spotlight with conviction

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Focal Point: Moody’s Gives India a Vote of Confidence Amid Global Chaos

▪️ Markets

▪️ Everything else you need to know today

▪️ Mindset: Upgrade your thinking with these 5 essential books

▪️ Stock Screener to up your game

FOCAL POINT

Moody’s Gives India a Vote of Confidence Amid Global Chaos

As global economies wrestle with trade wars, tariff battles, and geopolitical upheaval, India stands out as a pillar of relative stability. Moody’s latest outlook reaffirms this view, positioning India as a rare bright spot among emerging markets. The agency highlights India’s strong internal demand, reform-focused governance, and reduced reliance on external trade as key differentiators in today’s volatile global landscape.

What sets India apart? A steady rollout of production-linked incentives (PLIs), a focus on infrastructure-led growth, and an ongoing digital transformation have created a resilient economic engine. Unlike many emerging markets tied to commodity cycles or export volatility, India is increasingly driven by domestic consumption and long-term structural reforms.

Even recent flare-ups with Pakistan haven’t derailed investor confidence. That’s because India’s growth narrative is rooted in fundamentals, not flashpoints. For global investors seeking predictability in uncertain times, India offers a rare combination: scale, stability, and reform momentum.

Moody’s view signals more than macro strength, it hints that India is quietly becoming a stabilizing force in global portfolios. In a world where volatility is the new normal, India’s steady rise could offer the ballast investors didn’t know they needed.

MARKETS

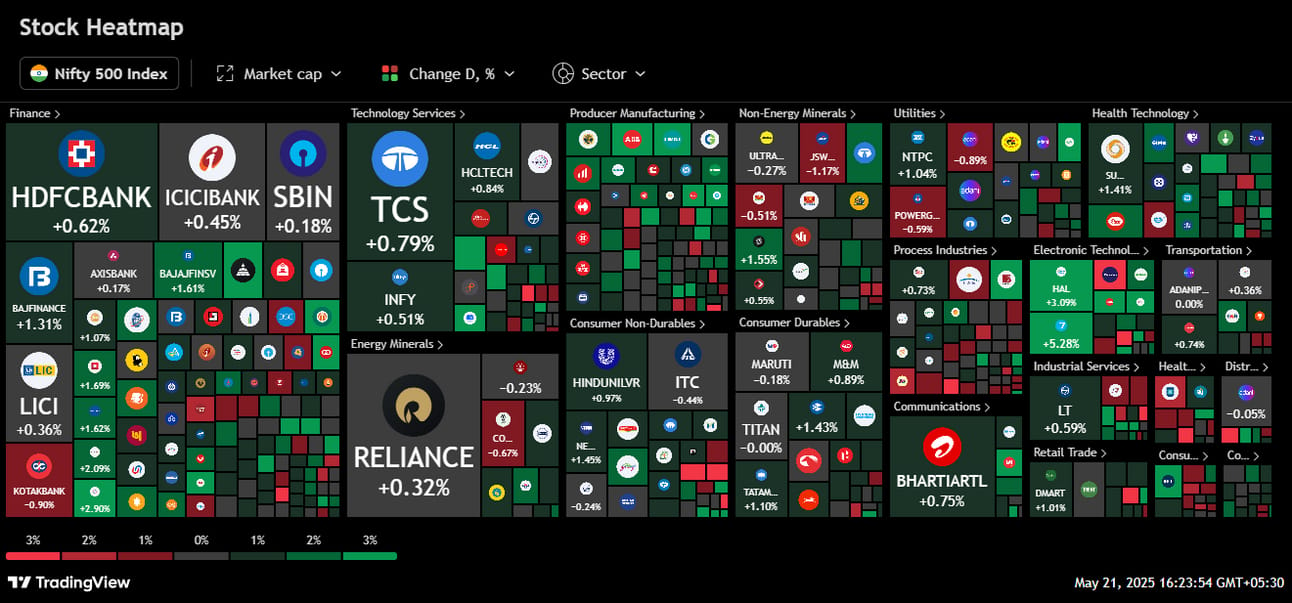

Markets ended on a strong note with broad-based gains across major indices. Sensex surged 410 points to 81,596, while Nifty 50 added 130 points to close at 24,813, both rising over 0.5%. The standout performer was Nifty Midcap 100, which jumped 0.78%, signaling strong interest in broader markets. Bank Nifty too edged up by 197 points, showing steady momentum in financials. Overall, the bulls had the upper hand, reflecting positive sentiment and renewed buying interest across sectors.

Closing figures as on 21.05.25 (3.30pm IST)

✅ SENSEX | 81,596.63 | +0.51% |

✅ NIFTY 50 | 24,813.45 | +0.52% |

✅ NIFTY BANK | 55,075.10 | +0.36% |

✅ NIFTY Midcap 100 | 56,619.60 | +0.78% |

✅ NIFTY Smallcap 100 | 17,483.00 | +0.38% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ Bharat Electronics surged 5.28% on strong defense sector optimism.

✅ Cipla jumped 1.93% amid buzz around upcoming pharma launches.

✅ Tata Steel rose 1.86% supported by global metal recovery.

✅ HDFC Life gained 1.69% as insurance stocks caught investor attention.

Top Losers

🔻 IndusInd Bank slipped 1.57% as profit booking kicked in after recent highs.

🔻 JSW Steel dropped 1.17%, likely tracking weakness in metal prices.

🔻 Kotak Mahindra eased 0.90%, facing pressure from lackluster banking sentiment.

🔻 Coal India shed 0.67%, possibly on muted coal demand or margin concerns.

NIFTY 500: : Buying Interest

FROM THE FRONTIER

Everything else you need to know today

🔼 Upswing: Morgan Stanley has bumped up India’s FY26 GDP forecast to 6.2%, crediting benign inflation, expected rate cuts, and strong government capex. The macro environment signals a potential “soft landing”, steady growth without economic overheating.

🚗 Momentum: CRISIL projects 7- 9% revenue growth for the auto components industry, powered by strong demand in 2-wheelers and passenger vehicles. Export orders and the EV boom are further electrifying this legacy sector.

🛸 Surge: Shares of drone companies soared up to 50% following “Operation Sindoor,” signaling massive investor optimism in next-gen defense tech. With drones becoming key to modern warfare, this sector is now firmly on the radar.

⚖️ Vindication: SAT has overturned SEBI’s insider trading order against Alchemy’s Lashit Sanghvi, tied closely to Rakesh Jhunjhunwala. The decision clears doubts around one of India’s most revered investing names.

ONEZERO-F ACADEMY

Upgrade Your Thinking with These 5 Essential Books

In today’s fast-moving world, your edge isn’t just what you know, it’s how you think, act, and adapt. Here are five powerful books that sharpen key skills for any founder, operator, or creative thinker:

👉 Deep Work by Cal Newport: Teaches laser-like focus in a distraction-filled world. It's not just about working harder, it's about working deeper.

👉 Influence by Robert Cialdini: A psychology classic on persuasion. Learn ethical tactics that help you lead, pitch, and close with confidence.

👉 The Psychology of Money by Morgan Housel: Financial wisdom simplified. Build a mindset that prioritizes behavior over spreadsheets for lasting wealth.

👉 Thinking, Fast and Slow by Daniel Kahneman: A masterclass in decision-making. Spot mental traps, rethink assumptions, and make sharper calls.

👉 Never Split the Difference by Chris Voss: High-stakes negotiation lessons from an FBI pro. It’s about connection, empathy, and tactical edge.

💡 Why this list matters:

Each book isn’t just theory, it’s a toolkit. In startups, careers, and life, these five skills compound faster than capital. Pick one, apply it, and level up.

SUPERCHARGE YOUR INVESTING SKILLS

75 Years of Investing Wisdom - Ray Dalio

STOCK SCREENER TO UP YOUR GAME

Next Multibagger Stock

by Sunil

Down from 52w high < 20 AND

Market Capitalization > 100 AND

Quick ratio > 1 AND Return on equity > Average return on equity 3Years AND Return on equity > 17 AND

OPM > 8 AND

Debt to equity < 1 AND

Promoter holding > 51 AND

Debt < Debt 3Years back AND

Cash from operations last year > 0 AND

Pledged percentage < 25 AND

OPM > OPM 5Year

Thanks for reading.

Until tomorrow!

Mohit & the OneZero-F team

OneZero-F Analytics is SEBI registered Research Entity in terms of SEBI (Research Analyst) Regulations, 2014 with SEBI Research Analyst No: INH000013837.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For more details, Click Here.

Click Here for Other DISCLAIMERS & DISCLOSURES