Read time: Under 4 minutes

Welcome Back Investor!

In a major legal turn, the Supreme Court has ordered a status quo on the liquidation of Bhushan Power & Steel Ltd, effectively halting the ongoing insolvency proceedings. This comes after objections were raised regarding due process and valuation concerns. The ruling puts a pause on asset sale plans, impacting creditors’ hopes of recovering over ₹47,000 crore.

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Focal Point: India becomes the 4th largest economy

▪️ Markets

▪️ Everything else you need to know today

▪️ Mindset: How to think like the wealthy and spend like the wise.

▪️ Special: The Finfluencer trap: When reels replace research

▪️ Stock Screener to up your game

FOCAL POINT

India Becomes the 4th Largest Economy

What’s Next on the Growth Ladder?

India has officially overtaken Japan and the UK to become the 4th largest economy in the world, clocking a GDP of $4.187 trillion. This is more than a bragging point, it’s a global signal that India’s economic engine is firing on all cylinders. With projections suggesting India could claim the 3rd spot by 2027, the momentum is real.

But let’s get clear-eyed, the gap to the top is wide. The U.S. leads with $30.51 trillion, followed by China at $19.23 trillion. Still, India’s trajectory, powered by digital adoption, infrastructure buildouts, and a young, hungry consumer base, is drawing parallels to a startup scaling fast.

💡 Why it matters: For founders, operators, and investors, this isn’t just a GDP milestone. It’s a wake-up call to the massive domestic opportunities ahead. From fintech to clean tech, local markets are getting deeper, and global capital is paying close attention.

📈 Bottom line: India’s economic rise isn’t coming, it’s already here.

Now the question is: Are you building for it?

MARKETS

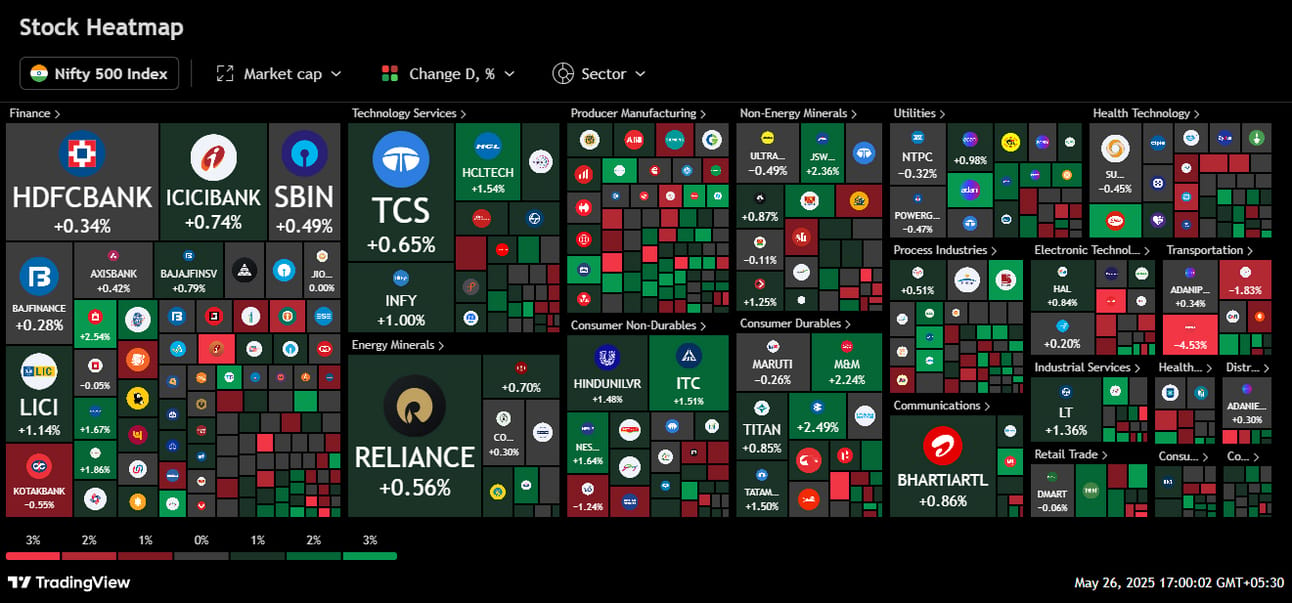

The Indian stock market soared on May 26th! Sensex surged 455 points to hit a record 82,176.45, while Nifty 50 touched the 25,000 mark with a 148-point gain. Nifty Bank and Nifty Midcap 100 also joined the rally, climbing 173 and 379 points respectively. Bulls are clearly in control, signaling strong investor confidence across large caps, banks, and midcaps. Keep an eye, momentum is building!

Closing figures as on 26.05.25 (3.30pm IST)

✅ SENSEX | 82,176.45 | +0.56% |

✅ NIFTY 50 | 25,001.15 | +0.60% |

✅ NIFTY BANK | 55,572.00 | +0.31% |

✅ NIFTY Midcap 100 | 57,067.25 | +0.67% |

✅ NIFTY Smallcap 100 | 17,707.80 | +0.37% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ Bajaj Auto: Zoomed up ₹217.50 (+2.49%), Auto giant riding strong momentum!

✅ JSW Steel: Added ₹23.80 (+2.36%), Metal shine continues with robust buying.

✅ M&M: Gained ₹67.50 (+2.24%), Auto sector in top gear with investor optimism.

✅ Hindalco: Rose ₹11.35 (+1.75%), Aluminum push lifts the stock higher.

Top Losers

🔻 Eternal: Slipped ₹10.75 (-4.53%), Profit booking hit hard after a strong run.

🔻 Kotak Mahindra: Down ₹11.50 (-0.55%), Banking heavyweight facing mild pressure.

🔻 UltraTech Cement: Dropped ₹57.00 (-0.49%), Muted action in cement counters.

🔻 Power Grid Corp: Eased ₹1.40 (-0.47%), Mild dip despite sectoral strength.

NIFTY 500: : Green Surge ✅

FROM THE FRONTIER

Everything else you need to know today

💸 Windfall: The RBI handed over ₹2.69 lakh crore to the government, 27% higher than last year, slashing the fiscal deficit by up to 30 bps. Experts say it’s a game-changer for FY25’s 4.4% GDP target.

🚀 Breakout: Groww Files for $1 Billion IPO in India, Fintech unicorn Groww is heading to the public markets with a $700M–$1B IPO, eyeing one of India’s biggest tech listings since Zomato.

🌧️ Momentum: Delhi Rains, Markets Still Shine-Despite monsoon clouds, Sensex hit 82,000 and Nifty crossed 25,000, bulls are clearly in charge.

📶 Goldmine: Airtel Could Be India’s Next Cash Machine, With data usage booming and ARPU rising, Bharti Airtel is being called “the new petrol” of India’s digital economy.

ONEZERO-F ACADEMY

How to think like the wealthy and spend like the wise.

Rich vs. Frugal

It’s not just income that builds wealth, it’s behavior. While some people accumulate assets quietly, others with high salaries still live paycheck to paycheck.

Here are 10 habits the truly wealthy live by:

1. Delay Gratification - They prioritize long-term wins over short-term splurges.

2. Invest Consistently - No market timing, just disciplined, compounding strategies.

3. Buy for Value - One quality item beats five cheap ones every time.

4. Prioritize Financial Education - Wealthy minds grow alongside growing bank accounts.

5. Track Every Rupee - Awareness equals control. Budgeting is their daily compass.

6. Avoid Lifestyle Inflation - Earnings rise, but spending doesn’t automatically follow.

7. Talk About Money - Open conversations replace confusion or avoidance.

8. Practice Emotional Discipline - Mindful choices replace impulse decisions.

9. Automate Their Finances - Systems handle savings, investments, and bills.

10. Define Success Personally - Peace of mind > status symbols.

💬 Takeaway: Wealth isn’t accidental, it’s built on everyday decisions. Which habit will you commit to today?

SPECIAL

The Finfluencer trap: When reels replace research

In today’s content-heavy world, finfluencers are turning complex money matters into flashy reels and viral soundbites. But here’s the catch: not all of them know what they’re talking about. Behind the charisma, many push risky advice, often without SEBI registration or accountability. One investor recently lost ₹15 lakh chasing viral tips.

The danger? Reels replace research. Simplified jargon replaces analysis. And entertainment often masks poor due diligence. These creators promise fast gains and financial freedom, but skip over the risks, volatility, and reality of long-term investing.

💡 How to stay safe:

✅ Follow SEBI-registered advisors

⚠️ Avoid “get-rich-quick” promises

🧠 Learn before you invest

Don’t let a like, share, or trending hashtag dictate your financial future. In money matters, credibility > clout. The smartest investor is the one who asks hard questions, before clicking follow.

SUPERCHARGE YOUR INVESTING SKILLS

How To Be Productive Every Day - Elon Musk

STOCK SCREENER TO UP YOUR GAME

Companies with good financials and moderate debt

by Aasvaada

Current price < 50 AND

Market Capitalization > 100 AND

Altman Z Score > 3 AND

Piotroski score > 3 AND

Graham AND

Volume > 50000 AND

Profit growth >

Debt = 0 AND

Total Assets

Thanks for reading.

Until tomorrow!

Mohit & the OneZero-F team

OneZero-F Analytics is SEBI registered Research Entity in terms of SEBI (Research Analyst) Regulations, 2014 with SEBI Research Analyst No: INH000013837.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For more details, Click Here.

Click Here for Other DISCLAIMERS & DISCLOSURES