Read time: Under 4 minutes

Welcome Back Investor!

India has officially approved the development of its first homegrown fifth-gen stealth fighter jet, a bold step amid growing tensions with Pakistan. Led by the Aeronautical Development Agency, the project aims to modernize India’s aging air fleet and reduce reliance on foreign suppliers. The move also opens doors for private players in defense manufacturing, a shift from HAL's delayed Tejas program. With drones and advanced jets now defining modern warfare, India’s bet on stealth signals serious strategic intent.

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Focal Point: Govt Announces Huge Support for Farmers and Infra

▪️ Markets

▪️ Everything else you need to know today

▪️ Mindset: How your daily routine might secretly be holding you back.

▪️ Stock Screener to up your game

FOCAL POINT

Govt Announces Huge Support for Farmers and Infra

The Indian Cabinet has approved a game-changing ₹2.07 lakh crore Minimum Support Price (MSP) package for Kharif crops, signaling strong support for the country’s agrarian core. This isn’t just a policy move, it’s a lifeline for farmers battling rising input costs and climate uncertainty. Alongside, a parallel interest subvention scheme aims to make farm credit more accessible and affordable.

👉 What this unlocks: More liquidity means farmers may now be more open to adopting agritech solutions, precision inputs, and digital platforms, creating fertile ground for startups and agri innovators.

🛣️ Infra Projects to Fuel Regional Growth:

🚄 Maharashtra: 135 km rail upgrade (Wardha-Ballarshah) to strengthen key industrial and agri freight corridors.

🚆 Madhya Pradesh: 41 km line expansion (Ratlam-Nagda) to ease rail congestion and improve mobility.

🛣️ Andhra Pradesh: New highway (Badvel-Nellore) to boost connectivity in underserved regions.

These aren’t just infrastructure upgrades, they're enablers for faster rural-to-urban supply chains and new economic zones.

💡 Why It Matters:

This dual strategy, empowering farmers and connecting markets, is a powerful growth catalyst. The message is clear: Bharat is the next big growth engine. Is your startup ready to ride the wave?

MARKETS

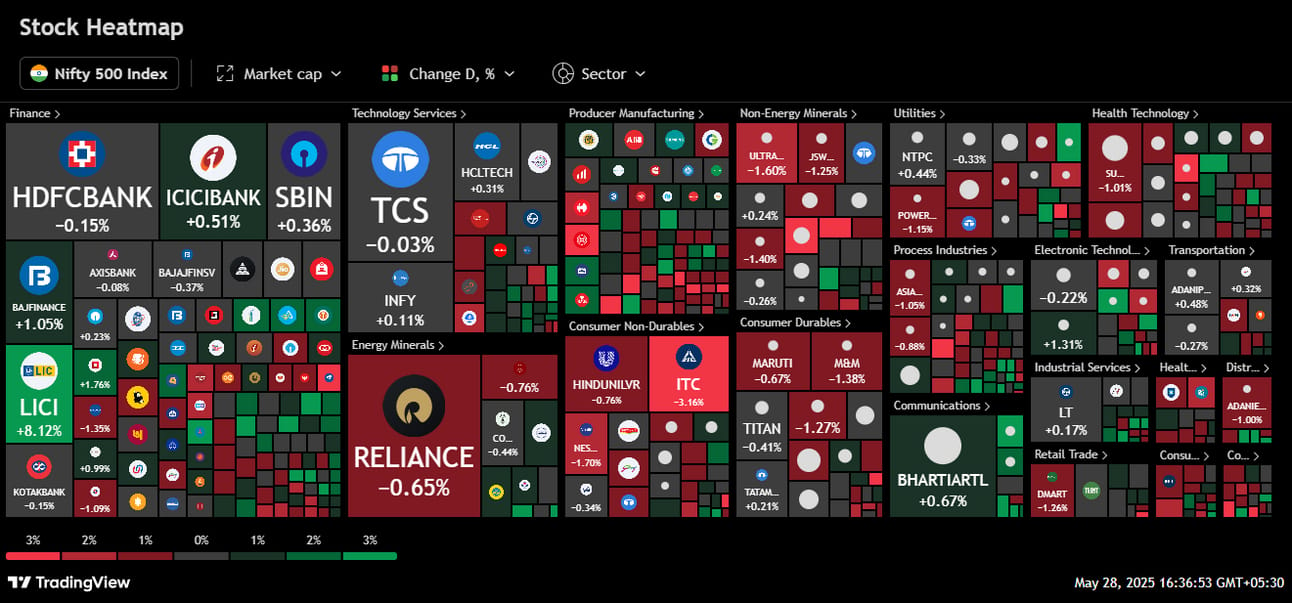

The Indian market showed a slight pullback today as the Sensex dipped by 239 points and Nifty 50 slipped 73 points, both losing around 0.3%. However, Bank Nifty bucked the trend, gaining 64 points (+0.12%), signaling some optimism in the banking sector. Midcap stocks stayed flat, down just 13 points. Overall, the market mood stayed cautious, with select buying seen in banks while broader indices paused after a strong rally.

Closing figures as on 28.05.25 (3.30pm IST)

🔻 SENSEX | 81,312.32 | -0.29% |

🔻 NIFTY 50 | 24,752.45 | -0.30% |

✅ NIFTY BANK | 55,417.00 | +0.12% |

🔻 NIFTY Midcap 100 | 57,141.40 | -0.02% |

✅ NIFTY Smallcap 100 | 17,784.00 | +0.10% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ HDFC Life: The stock gained 1.76%, possibly due to positive investor sentiment and expectations of strong performance in the insurance sector.

✅ Bharat Electronics Ltd (BEL): BEL saw a 1.31% increase, which could be attributed to robust order inflows and a strong order book position, reflecting confidence in the company's future earnings.

✅ Bajaj Finance: The stock rose by 1.05%, likely driven by expectations of continued growth in the consumer finance segment and strong quarterly results.

✅ Bharti Airtel: Shares of Bharti Airtel increased by 0.67%, potentially due to positive developments in the telecom sector and expectations of subscriber growth.

Top Losers

🔻 ITC: slipped 4.13% to ₹413 after a massive block deal saw 38.5 crore shares (3% equity) change hands, triggering selling pressure.

🔻 IndusInd Bank: dropped 1.89% to ₹805.15 after disclosing a net worth hit from discrepancies in derivative accounts, triggering a sharp market reaction.

🔻 Nestle: slipped 1.70% after BoFA Securities downgraded the stock from 'Neutral' to 'Underperform', dampening investor sentiment.

NIFTY 500: : Muted Session 🔇

FROM THE FRONTIER

Everything else you need to know today

🌐 Globalize: PayPal Payments Private Limited, the Indian arm of PayPal Holdings, has received in-principle approval from the Reserve Bank of India (RBI) to operate as a Payment Aggregator for Cross Border Exports (PA-CB-E).

📍 New Base: IndiGo is set to become the first airline to commence operations from the newly developed Navi Mumbai International Airport (NMIA), developed by the Adani Group. Starting with 18 daily departures to over 15 cities, the airline plans to expand to 79 daily departures by November 2025 and over 100 by March 2026.

📊 Earnings Watch: India's volatility index, the India VIX, has declined over 3% to 17.91, indicating reduced market fear. Analysts suggest that the bulk of event-driven volatility is behind us, and investors should now focus on corporate earnings, as early indicators point to improving performance by Indian companies.

⏳ Rain Risk: The timing of monsoon rains, particularly in July and August, is more critical for the stock market than the overall monsoon average. While a normal monsoon benefits the economy through strong crop output, its direct correlation with equity market returns remains inconsistent.

ONEZERO-F ACADEMY

How your daily routine might secretly be holding you back.

These habits might look harmless on the surface, even normal. But over time, they can quietly chip away at your confidence, productivity, relationships, and peace of mind. Here’s what to watch out for:

1. Procrastination: Delaying tasks might feel harmless, but it kills momentum and builds long-term stress.

2. Negative Self-Talk: Constantly doubting yourself chips away at your confidence and fuels anxiety.

3. Lack of Discipline: Without self-control, goals stay dreams and consistency becomes impossible.

4. Addiction to Comfort: Choosing ease over effort keeps you stuck in the same place, growth needs discomfort.

5. Blaming Others: Pointing fingers feels easy, but it takes away your power to change anything.

6. Wrong Company: The people around you can either lift you up or slowly drag you down.

7. Ignoring Health: Poor sleep, bad food, and no exercise slowly damage your energy and focus.

8. Living in the Past: Holding on to regret or nostalgia blocks you from building your future.

9. Avoiding Responsibility: Dodging ownership keeps you reactive instead of proactive in your life.

10. Not Setting Goals: Without direction, you drift, and life moves on without clear progress.

These habits don’t ruin your life in a day, they do it quietly over time.

SUPERCHARGE YOUR INVESTING SKILLS

STOCK SCREENER TO UP YOUR GAME

Companies which had a turnaround and had quarterly results from loss to profit.

by Firstuser

Profit after tax latest quarter > .33 AND

Profit after tax < 0 AND

Market Capitalization > 10 AND

Current price > 5

Thanks for reading.

Until tomorrow!

Mohit & the OneZero-F team

OneZero-F Analytics is SEBI registered Research Entity in terms of SEBI (Research Analyst) Regulations, 2014 with SEBI Research Analyst No: INH000013837.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For more details, Click Here.

Click Here for Other DISCLAIMERS & DISCLOSURES