Read time: Under 4 minutes

Welcome Back Investor!

In a move that’s raising eyebrows, Goldman Sachs has trimmed India’s growth outlook, citing rising tariff tensions and an unusually rare risk: low inflation. While the country has been a global growth darling, this revision signals potential bumps ahead for consumption and investment. Investors and policymakers are watching closely.

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Impact News

▪️ Markets

▪️ Everything else you need to know today

▪️ Special

▪️ Mindset

▪️ Stock Screener to up your game

IMPACT NEWS

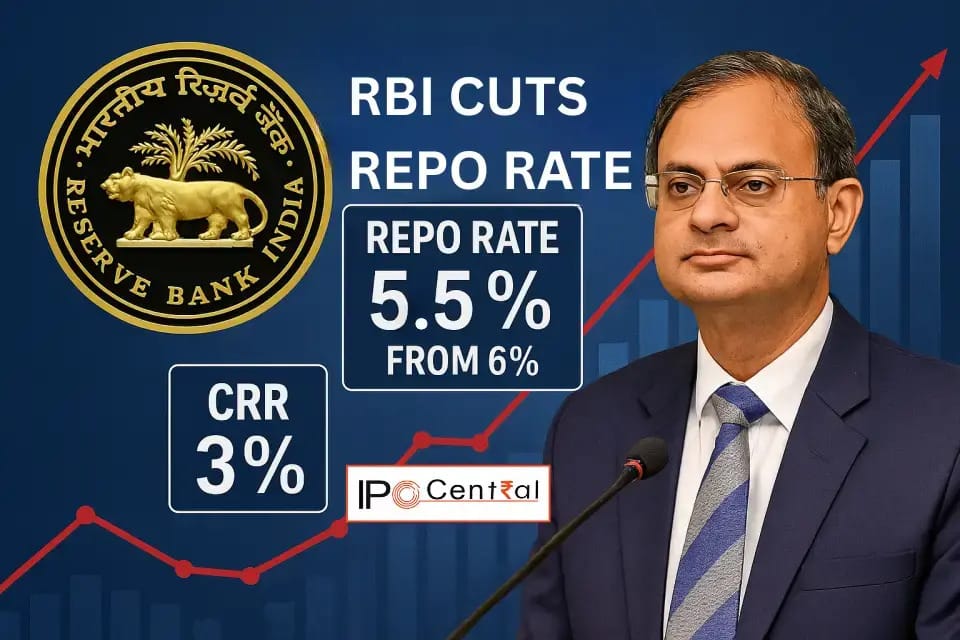

🧭 RBI Hits Pause, But Caution Creeps In

India's central bank held the repo rate steady at 5.5%, signaling confidence in its prior 100 bps rate cuts. But beneath the calm lies a shifting undercurrent.

📉 Inflation, once at 2.1%, is expected to inch above 4% later this year, driven by supply-side risks and global uncertainty. Still, the RBI remains unfazed for now choosing to hold rather than hike. The MPC's unanimous decision reflects a wait-and-see mindset, focused on keeping liquidity intact without oversteering policy.

🌍 The global chessboard is shifting. Trump’s threatened U.S. tariffs over India’s Russian oil imports could stoke fresh volatility. So far, the RBI appears unshaken but such external risks are difficult to ignore.

💬 Why it matters:

With growth projected at 6.5%, India’s economic engine is running. But late-year inflation creep and geopolitical friction could pressure rate policy again. The RBI’s message is clear: We’ll act if we must-but not before.

MARKETS

The Indian stock market showed mixed signals today! The Sensex slipped by 166.26 points (-0.21%) to settle at 80,543.99, while the Nifty 50 also dropped 75.35 points (-0.31%) to 24,574.20, indicating mild bearish sentiment in large caps. However, Nifty Bank stood strong with a modest gain of 50.90 points (+0.09%), offering some relief. The biggest drag came from the Nifty Midcap 100, which tanked 457.10 points (-0.80%), signaling pressure in midcap stocks. Overall, the market is facing profit booking and cautious trading vibes today.

Closing figures as on 06.08.25 (3.30pm IST)

🔻 SENSEX | 80,543.99 | -0.21% |

🔻 NIFTY 50 | 24,574.20 | -0.31% |

✅ NIFTY BANK | 55,411.15 | +0.09% |

🔻 NIFTY Midcap 100 | 56,749.75 | -0.80% |

🔻 NIFTY Smallcap 100 | 17,662.60 | -1.13% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ Asian Paints (+2.2%) Margins lifted by bullish investors thanks to a renewed joint venture with PPG extended up to 2041, along with signs of improving urban and rural demand amid a healthy monsoon.

✅ HDFC Life (+1.9%) Insurance stock gained as a defensive play, holding up well despite overall market pressure.

✅ Trent (+0.7%) Retailer Trent rose modestly fueled by its upcoming inclusion into the Sensex, slated to replace former components alongside Bharat Electronics.

✅ BEL (+0.8%) Defence stock rallied after the government approved projects worth ₹67,000 crore, and it’s also set for Sensex inclusion, prompting strong buying.

Top Losers

🔻 Wipro (–2.4%) Falls attributed to weak sentiment across the IT sector after commentary from peers about macro headwinds and slowing demand.

🔻 Sun Pharma (–2.3%) Drugmaker came under pressure amid concerns over potential U.S. tariffs on Indian pharma exports. Adding to the bearish tone, the NPPA denied Sun Pharma’s request for separate pricing on its antibiotic suspension pack.

🔻 IndusInd Bank (–1.9%) Dropped after being removed from the Sensex in an index reshuffle along with Nestle India triggering passive selling and portfolio adjustments.

🔻 Jio Financial (–1.9%) The new financial arm of Jio saw profit booking amid weak broader market sentiment and limited fresh triggers.

Q4 RESULTS

Company | YoY | QoQ |

|---|---|---|

👍🏻 | 👎🏻 | |

👎🏻 | 👎🏻 | |

👎🏻 | 👎🏻 | |

👎🏻 | 👎🏻 | |

👍🏻 | 👍🏻 |

Click on company name for result pdf

INDIA FRONTIER

Everything else you need to know today

🚀 Debut: India's largest depository, NSDL, made a splashy 5% gain on its Dalal Street debut marking a solid vote of confidence in digital market infrastructure. The post-IPO buzz is real, but the long-term playbook is still unfolding.

🛑 False: SEBI’s chairman has officially labeled the reports on banning weekly derivatives expiry as “false and speculative,” putting an end to the swirling panic. The market exhaled in relief, with BSE shares rebounding sharply.

🎮 Split: Gaming giant Nazara Technologies is prepping for a major shareholder treat its board will consider a stock split and bonus issue on August 12. The stock jumped 2% in response, signaling bullish excitement.

💰 Cost: RBI Governor Shaktikanta Das clarified there are costs behind UPI transactions but who foots the bill remains a puzzle. As India doubles down on its digital payments revolution.

SPECIAL

📉 From Calm to Concern: RBI Warns of Inflation Surge Ahead

India’s inflation may have cooled to 2.1%, but the Reserve Bank of India isn’t celebrating just yet. In its latest monetary update, the RBI flagged this relief as temporary, warning that inflation could climb back above 4% by year-end.

Despite global headwinds including Trump’s tariff threats linked to India’s Russian oil imports the central bank chose to maintain the repo rate at 5.5%, reflecting a "neutral, cautious" stance.

🛡️ Why this matters:

While India’s GDP growth forecast remains strong at 6.5%, the RBI is clearly walking a tightrope balancing between stimulating growth and containing inflation. If external shocks like oil price spikes or trade disruptions materialize, monetary tightening may return faster than expected.

🇮🇳 Interestingly, the RBI remains largely unfazed by U.S. trade pressure, believing India’s macro fundamentals are robust enough to withstand such geopolitical tremors.

THE HANOOMAAN INSTITUTE

💰 Wealth Comes at a Cost - But It’s a Choice Worth Making

Behind every self-made millionaire is a quiet series of sacrifices that compound over time.

It’s not about flashy hacks or viral hustle.

It’s about deliberate, often uncomfortable, trade-offs.

🧠 5 powerful sacrifices the wealthy make early and intentionally:

1. Comfort Today for Freedom Tomorrow: They delay gratification. While others splurge, they invest in assets, skills, and systems.

2. Popularity for Purpose: They choose to be misunderstood, skipped from parties, or even judged… all for a mission bigger than social approval.

3. Entertainment for Education: TV is replaced by books. Scrolling becomes studying. They trade hours of consumption for mastery.

4. Being Liked for Being Respected: They set boundaries, say "no," and prioritize long-term integrity over short-term likability.

5. Short-Term Gains for Long-Term Games: They build habits, not hype. Systems, not spurts. Wealth creation is a marathon with discipline as fuel.

💭 Wealth isn't just about earning more it's about becoming more.

👉 If you want to be financially free 5 years from now, start by making these small sacrifices today.

SUPERCHARGE YOUR INVESTING SKILLS

STOCK SCREENER TO UP YOUR GAME

Highest Dividend Yield Shares

by - Pratyush

Dividend yield > 2 AND

Dividend Payout < 100% AND

( Profit growth 3Years > 10 OR

Profit growth 5Years > 10 OR

Profit growth 7Years > 10 ) AND

Average 5years dividend > 0 AND

Dividend last year > Average 5years dividend AND

Profit after tax > Net Profit last year * .8 AND

Dividend last year > .35

Thanks for reading.

Until tomorrow!

Hanoomaan India Business team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. More details click here