Read time: Under 4 minutes

Welcome Back Investor!

India’s private sector surged in May, with the Composite PMI hitting 61.7, driven by booming services like finance and tourism. But rising input costs are stoking inflation concerns. As growth accelerates, the RBI faces a tricky balancing act between fueling expansion and keeping prices in check.

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Focal Point: RBI Projects Confidence amid Global Slowdown

▪️ Markets

▪️ Everything else you need to know today

▪️ Mindset: Upgrade your thinking with these 5 essential books

▪️ Special: Leela Hotels IPO: Luxury steps into the Limelight

▪️ Stock Screener to up your game

FOCAL POINT

RBI Projects Confidence Amid Global Slowdown

The Reserve Bank of India’s May 2025 bulletin strikes a confident note: India is weathering global headwinds with grit and grace. While the world grapples with policy uncertainty, slowing trade, and financial volatility, India stands out with strong macro fundamentals.

Consumer price inflation dropped to 3.16% in April, the lowest since July 2019, thanks to easing food prices. Industrial production and services activity continue to show momentum, while rural consumption and government-led infrastructure spending remain key growth drivers.

🧠 Why it matters: In a world jittery about stagnation and shocks, India is emerging as a rare story of stability and sustained expansion. The RBI’s tone? Cautiously optimistic, with a steady hand on the tiller.

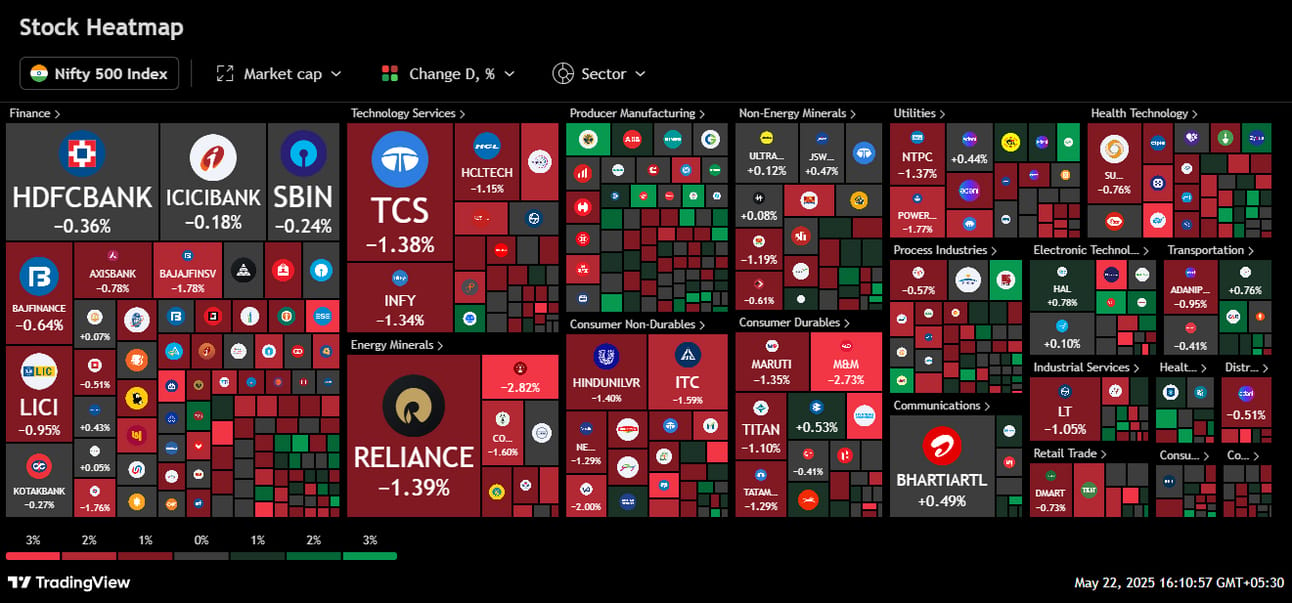

MARKETS

Market witnessed a broad-based decline with key indices closing in the red. The SENSEX dropped 644 points (-0.79%), and the NIFTY 50 slid by 204 points (-0.82%), signaling profit-booking and cautious sentiment. The NIFTY Bank showed relative resilience, dipping only 0.24%, while the Midcap 100 fell 295 points (-0.52%), reflecting broader market pressure. Investors are advised to stay alert, as volatility seems to be back on the table!

Closing figures as on 22.05.25 (3.30pm IST)

🔻 SENSEX | 80,951.99 | -0.79% |

🔻 NIFTY 50 | 24,609.70 | -0.82% |

🔻 NIFTY BANK | 54,941.30 | -0.24% |

🔻 NIFTY Midcap 100 | 56,324.85 | -0.52% |

🔻 NIFTY Smallcap 100 | 17,503.10 | -0.26% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ IndusInd Bank: Banking bulls roar with a 1.95% surge backed by strong volume.

✅ Bajaj Auto: Steady ride for Bajaj Auto as it clocks gains of 0.53%.

✅ Bharti Airtel: Airtel dials up green with a modest 0.49% climb.

✅ JSW Steel: Metal momentum holds as JSW Steel edges up by 0.47%.

Top Losers

🔻 ONGC: Crude cracks hit ONGC hard, down by 2.82%.

🔻 M&M: Auto heat drags M&M down 2.73% in a sharp pullback.

🔻 Tech Mahindra: IT under pressure, Tech Mahindra slips 2.04%.

🔻 Hindalco: Metal fatigue shows as Hindalco drops 2.03%.

NIFTY 500: : Broad Selloff

FROM THE FRONTIER

Everything else you need to know today

📉 Pressure: Rising US yields are triggering foreign outflows from Indian debt, weakening the rupee and raising borrowing costs. Equities may feel the heat if this bond rout lingers.

🏦 Countdown: After years of delay, NSE’s IPO could finally go live as pending regulatory issues near resolution. This could be India's biggest market debut since LIC.

☀️ Greenlight: Reliance will kickstart solar module production in Gujarat in 2024, advancing its $10B clean energy push. A big move to lead India’s renewable energy charge.

🛵 Accelerate: Honda Invests ₹920 cr at its Gujarat facility by 2027, targeting rising demand in 2- & 3-wheeler markets and preparing for the EV shift.

ONEZERO-F ACADEMY

5 Status Symbols That Look Like Success (But Aren’t)

What if the things we buy to “look rich” are actually keeping us from getting rich?

In a thought-provoking piece, how many in the middle class confuse status symbols, like luxury cars, branded clothes, and designer homes, for actual financial success. These aren’t assets… they’re liabilities in disguise.

1. Luxury Cars: A ₹60 lakh car might turn heads, but the EMI quietly robs your future investments, true wealth isn’t parked in the driveway.

2. Designer Clothes: Wearing ₹20K sneakers doesn’t grow your net worth, millionaires often dress modestly because their assets do the talking.

3. Big Homes: Large houses come with hefty EMIs, maintenance, and stress. It’s not an investment if it bleeds your cash flow.

4. Elite Private Schools: Expensive tuition doesn’t guarantee smarter outcomes, mindset and values at home often matter more.

5. Lavish Vacations: That Europe trip on credit may look dreamy but delays your financial independence. Joy ≠ Justification.

💡 Wealth isn’t loud. It’s quiet, consistent, and compoundable.

SPECIAL

Leela Hotels IPO: Luxury Steps into the Limelight

Schloss Hotels, the operator of India’s iconic The Leela brand, is opening its IPO from May 26–28, targeting a raise of ₹3,500 crore. The issue includes ₹2,500 crore of fresh equity and a ₹1,000 crore offer for sale, with a price band of ₹413–₹435 per share, valuing the company at around ₹14,500 crore.

Backed by Brookfield Asset Management, Leela has already slashed its debt by 32% and turned profitable last year, with revenues up 11%. The proceeds will be used primarily to further reduce debt and fuel future expansion, including a bold entry into wildlife and spiritual tourism.

📌 Why it matters: As India’s luxury travel segment booms, Leela’s IPO could be a marquee moment, blending brand legacy with fresh capital and investor interest.

SUPERCHARGE YOUR INVESTING SKILLS

Debt Is a Trap, And You’re the Bait | Dave Ramsey

STOCK SCREENER TO UP YOUR GAME

Capacity expansion

by Satya Prakash

(

(Sales growth 3Years > 12% AND

Net block > Net block 3Years back * 2)

OR

(Net block + Capital work in progress ) > 1.5 * (Net block preceding year + Capital work in progress preceding year )

)

AND

Sales last year > 25 AND

Debt to equity < 3 AND

Market Capitalization > 25

Thanks for reading.

Until next time!

Mohit & the OneZero-F team

OneZero-F Analytics is SEBI registered Research Entity in terms of SEBI (Research Analyst) Regulations, 2014 with SEBI Research Analyst No: INH000013837.

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For more details, Click Here.

Click Here for Other DISCLAIMERS & DISCLOSURES