Read time: Under 4 minutes

Welcome Back Investor!

India’s state-owned banks are set to raise a hefty $5.25 billion in 2025–26 through Qualified Institutional Placements, signaling a bold move to strengthen their capital base without leaning on government rescues. By tapping private institutional investors, these banks aim to boost lending muscle, stay competitive with agile private rivals, and fuel India’s booming credit demand all while meeting tougher regulatory norms.

Let’s dive in!

But before we start!

If you find the contents of this email useful, subscribe now & share with your friends.

Today’s Market Menu

▪️ Impact News

▪️ Markets

▪️ Everything else you need to know today

▪️ Special

▪️ Mindset

▪️ Stock Screener to up your game

IMPACT NEWS

💰 SBI’s $2.9 Billion Play: India’s Banking Giant Levels Up

“When the biggest bank doubles down, it’s time to watch the scoreboard.”

India’s largest lender, State Bank of India (SBI), is reportedly hitting the market with a massive $2.9 billion share sale, possibly as early as next week.

This isn’t just another fundraise it’s a statement. SBI is loading up its war chest to lend more boldly into India’s booming credit cycle. Retail, MSME, infrastructure everyone’s hungry for capital, and SBI wants the firepower to deliver.

✅ Why this matters:

1️⃣ Bigger balance sheet = bigger lending muscle. Fresh equity means SBI can grow its loan book aggressively without sweating capital adequacy ratios.

2️⃣ Beating private rivals at their own game. With fintech challengers and nimble private banks upping their digital game, SBI knows staying big isn’t enough staying competitive is the real fight.

3️⃣ Market trust over bailouts. Tapping public markets instead of leaning on government infusions signals strength and invites institutions to join the bet on India’s growth story.

💡 If SBI pulls this off smoothly, it could inspire other PSUs to pivot more funding needs to the market not the state.

💬 Would you buy SBI’s growth story at these levels or bet on private banks? Drop your thesis let’s see where smart money stands.

MARKETS

India’s stock market slipped today as the Sensex dropped 0.41% to 83,190 and the Nifty 50 fell 0.47% to 25,355, mainly due to profit-booking in IT stocks like TCS, Infosys, and Wipro ahead of TCS’s Q1 results, which investors expect to show muted growth. Lingering US-India trade tariff worries and the end of a tariff truce also kept sentiment cautious. Adding pressure, Reliance Industries dipped after reports of delaying its mega IPO.

Closing figures as on 10.07.25 (3.30pm IST)

🔻 SENSEX | 83,190.28 | -0.41% |

🔻 NIFTY 50 | 25,355.25 | -0.47% |

🔻 NIFTY BANK | 56,956.00 | -0.45% |

🔻 NIFTY Midcap 100 | 59,159.95 | -0.30% |

🔻 NIFTY Smallcap 100 | 18,956.25 | -0.27% |

🔎 In Focus

Stock Performance:

Top Gainers

✅ Maruti Suzuki: Revved up +1.44% strong demand buzz and steady sales keep the auto giant in the fast lane.

✅ IndusInd Bank: Climbed +1.44% healthy loan growth vibes and sector tailwinds drive fresh buying.

✅ Tata Steel: Up +1.04% firm global metal prices and positive domestic demand strengthen sentiment.

✅ Bajaj Finance: Added +0.75% strong retail loan traction and steady asset quality keep it in investors’ good books.

Top Losers

🔻 Bharti Airtel: Down -2.73% profit-booking hits hard after a recent rally; investors cautious over 5G and fintech spend.

🔻 HDFC Life: Slipped -1.91% muted insurance sales trends weigh on sentiment.

🔻 Asian Paints: Dropped -1.91% raw material cost worries and monsoon uncertainty put pressure on paints.

🔻 Apollo Hospital: Dipped -1.47% profit-booking drags after a strong run-up on solid earnings.

INDIA FRONTIER

Everything else you need to know today

🔥 Overheated: India’s stock market might be riding high, but Kotak AMC’s Head of Equity Research has a reality check: elevated valuations could put a lid on returns this year. Even with India’s growth story in full swing, stretched prices might test investors’ patience.

🎭 Showdown: India’s biggest stock exchange is inching closer to its long-awaited IPO and merchant bankers are already lining up for what’s being dubbed a “beauty parade.” With NSE’s massive listing on the horizon, expect fierce competition among bankers to bag the coveted deal.

🌐 Breakthrough: Talks for a new India–US trade pact are picking up pace just weeks ahead of a key tariff deadline in August. With duties on the line, negotiators are scrambling to iron out sticking points that could impact everything from tech to textiles.

⚙️ Squeeze: Analysts are warning that fresh US tariffs could throw a wrench in India’s downstream copper exports. If new duties kick in, local players might see softer demand and squeezed margins a ripple effect that could hit everything from wiring to industrial parts.

SPECIAL

🌐 India–US Trade Reset: Tariffs Loom, Stakes Soar

Trade deals aren’t just policy they’re the hidden levers behind your next invoice, your factory floor, your job.

Right now, India and the US are locked in high-pressure talks to seal a fresh trade agreement before Trump-era tariffs snap back into place.

No official tariff letter has landed yet but the clock is ticking. If the deal stalls, legacy duties could come roaring back as early as August, hiking costs for Indian exports from textiles to auto parts. That means Indian businesses could suddenly find US buyers pulling back or renegotiating, just when global supply chains are already tight.

✅ Why this matters for founders and operators:

1️⃣ Tariff swings change unit economics overnight. A few percentage points here or there can make or break your competitiveness in global markets.

2️⃣ Market access is leverage. A modernised trade pact could unlock billions in two-way flows, helping India’s exporters ride out other global headwinds.

3️⃣ Buyers feel it too. For US companies dependent on Indian goods, renewed duties mean higher input costs a ripple that hits shelves, projects, and margins.

💡 Global supply chains run on trust, not just trucks. Clear rules and stable tariffs are the grease that keeps them moving.

If you run exports or source from India, how are you hedging trade risks this quarter? Drop your strategies let’s compare notes.

THE HANOOMAAN INSTITUTE

🏦 Is Your Wallet Bleeding While You Sleep?

Small leaks sink big ships especially your bank account.

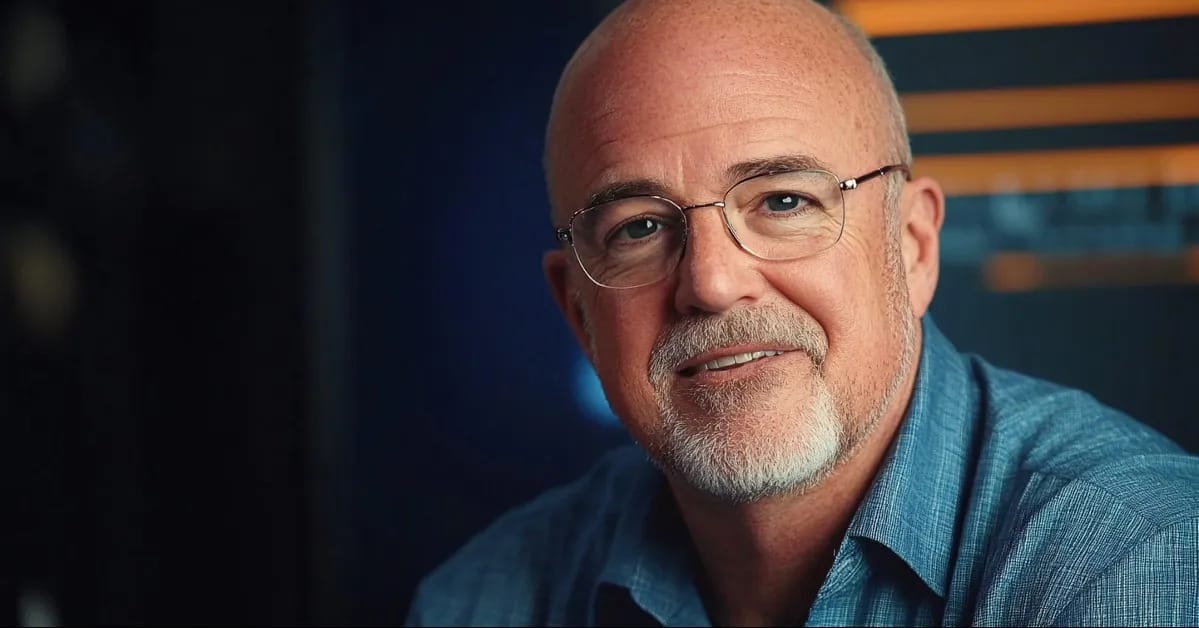

Personal finance legend Dave Ramsey just called out 5 daily habits that quietly drain your money and keep you stuck in a rut.

✅ The wallet audit:

1️⃣ Budget Blindness: No budget = no roadmap. You’ll wonder where your paycheck went every. single. month.

2️⃣ Mindless Spending: That daily $6 latte, auto-renew subscriptions, impulse Amazon buys tiny drips that become tidal waves over a year.

3️⃣ Credit Card Crutch: Treating credit as free money? It’s not compound interest works against you here.

4️⃣ Paycheck-to-Paycheck Trap: One surprise bill can flip your month upside down without a safety net, you stay stuck.

5️⃣ Procrastination Nation: Waiting to invest or pay off debt costs you precious compound growth. Time really is money.

💡 Ramsey’s fix? Get intentional. Write a real budget (and stick to it). Plug those daily money leaks. Pay off debt like your future depends on it because it does. Build a cushion, then invest early, even if it’s small.

👉 Which habit is costing you the most right now? Drop it below your future self will thank you.

SUPERCHARGE YOUR INVESTING SKILLS

STOCK SCREENER TO UP YOUR GAME

Undervalued stocks

by - Sanjay

Market Capitalization >200 AND

Return on invested capital > 15 AND

Price to Earning < 5

Thanks for reading.

Until tomorrow!

Hanoomaan India Business team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. More details click here